An All-Inclusive Approach

to Planning for Professionals

Welcome to Forward-Thinking Financial Risk Management

Let’s Talk About It

Our customizable Prestige Retirement Plan allows us to help professionals maximize tax deductible contributions greater than traditional options.

Here’s how it works:

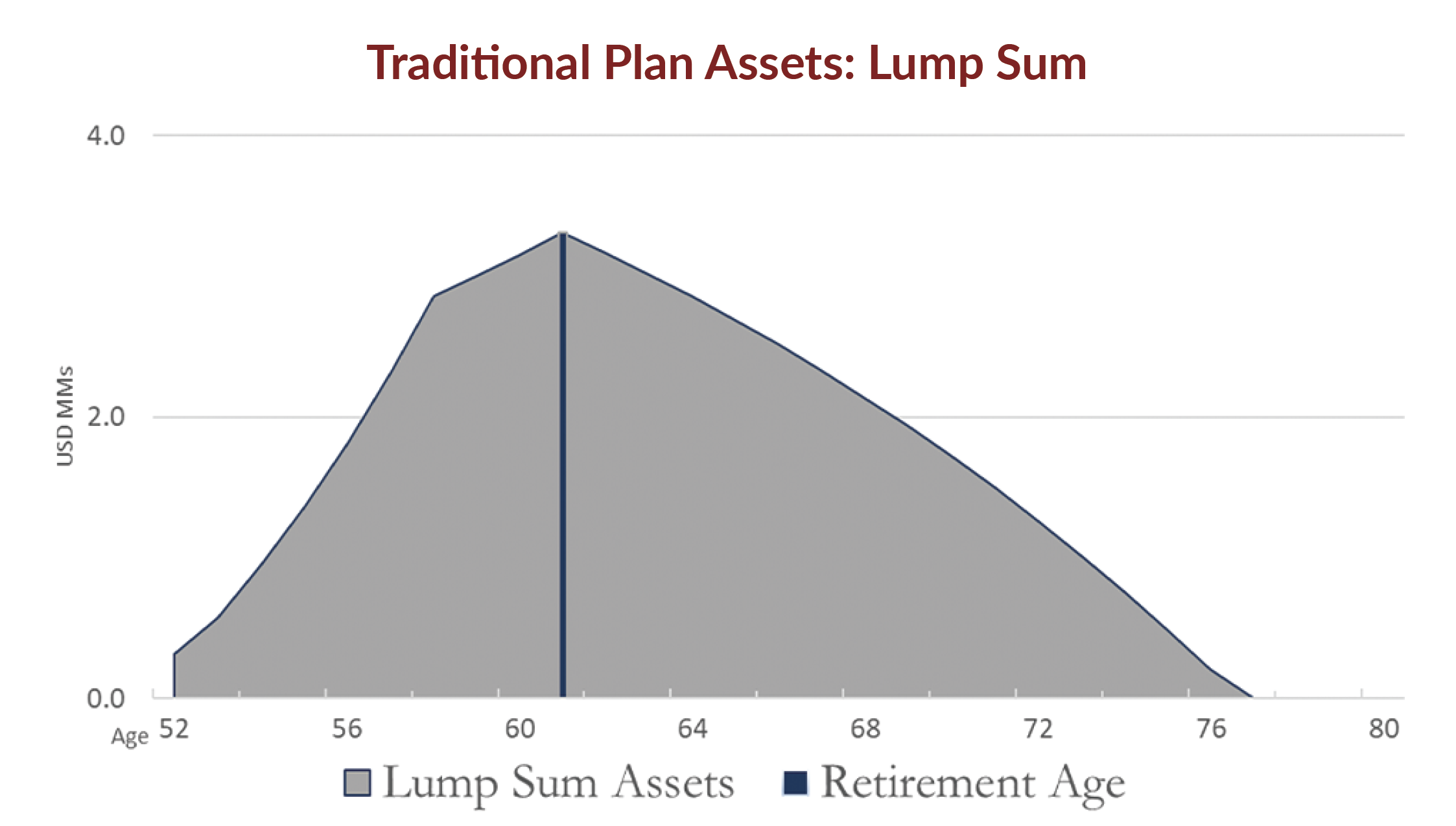

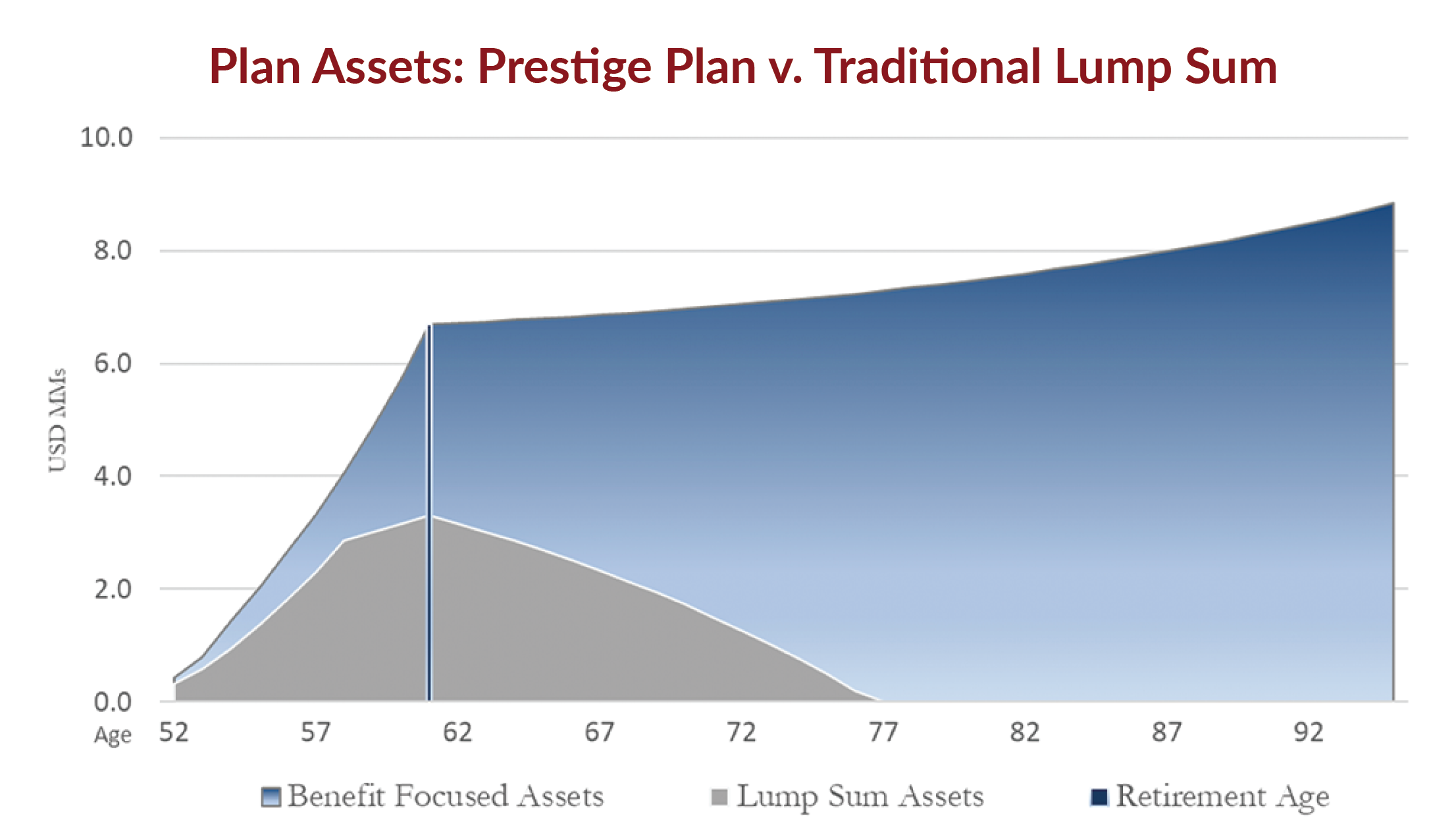

- This plan removes the lump sum option because when you have a lump sum distribution option in a defined benefit plan, the IRS restricts how you value the benefit.

- It changes the form of benefit from a single life basis to a joint life basis allowing us to fund for a benefit payable to both the business owner and their spouse.

- The plan adds a large insured death benefit which greatly increases the range of deductible contributions and fully funds the pension for the surviving spouse.

How a Prestige Retirement Plan Can Impact You!

- Maximizes the magnitude of plan contributions

- Higher pre-tax contributions

- Greater tax deferral plan

- Lifetime income for participant and spouse providing a monthly income stream to retire rather than a lump sum payout

- 100% survivor annuity to spouse

- Assets can potentially fund the retirement benefits of the next generation of employees

- The insured death benefit net of cash value is tax-free and premiums are payable pre-tax